The acronym chaps stands for clearing house automated payments and refers to automated bank to bank payments that are made on the same day.

Clearing house automated payment system advantages.

What is chaps clearing house automated payment system.

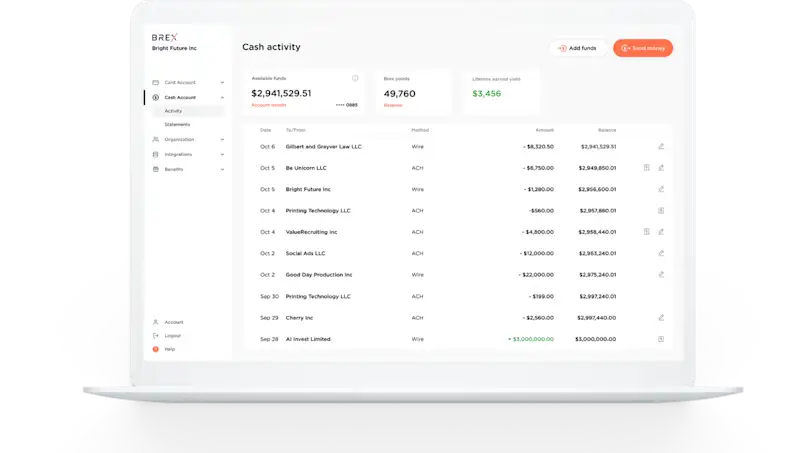

Making online purchases without having to use a credit card or check.

Advantages of automated clearing house.

The clearing house automated payments system chaps is a u k based system that facilitates large british pound denominated money transfers.

Multinational banks principally use chaps.

Find out when to use the ach network and the benefits of the payment system.

Chaps is one of the largest high value payment systems in the world providing efficient settlement risk free and irrevocable payments.

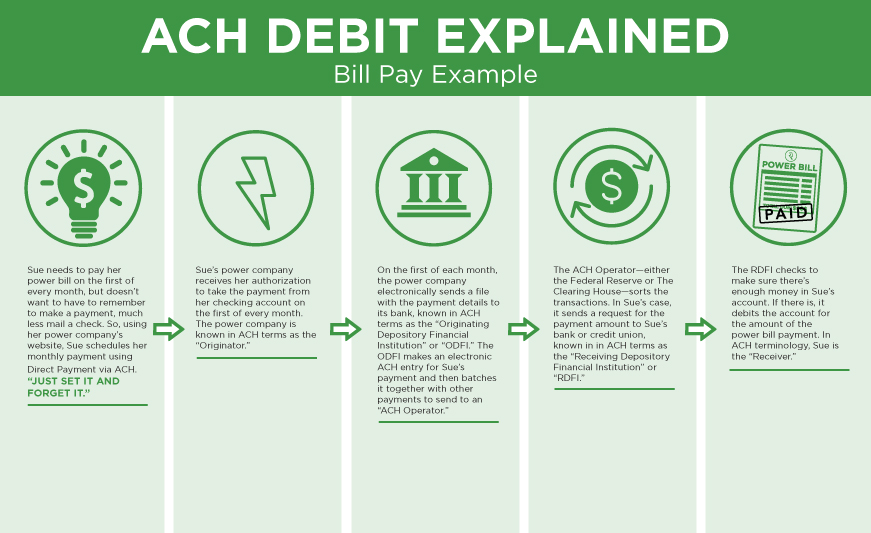

The automated clearing house network ach is an electronic funds transfer system run by nacha formerly the national automated clearing house association.

The ach system is designed to process batches of payments containing numerous transactions and charges fees low enough to encourage its use for low value.

Together with the fedwire funds service which is operated by the federal reserve banks chips forms the primary u s.

By 2015 it was settling well over us 1 5 trillion a day in around 250 000 interbank payments in cross border and domestic transactions.

Minimize paper records that carry sensitive banking information.

Automating bill payments to avoid late fees and missed payments.

The clearing house interbank payments system chips is a united states private clearing house for large value transactions.

Responsibility for the chaps system transferred to the bank of england in november 2017.

The clearing house automated payment system chaps is a way of transferring sums of money the same day.

Learn the advantages of using the automated.

The automated clearing house ach is the primary system that agencies use for electronic funds transfer eft with ach funds are electronically deposited in financial institutions and payments are made online.

Get paid faster with an automated payment and without waiting for a check to clear.

An automated clearing house ach is a computer based electronic network for processing transactions usually domestic low value payments between participating financial institutions it may support both credit transfers and direct debits.

Chaps is typically used for high value urgent payments such as those transferred by a solicitor between banks and current accounts during a house purchase.

:max_bytes(150000):strip_icc()/what-does-ach-stand-for-315226_FINAL-a68079317cfb403aaa73cab72e1762ab.png)